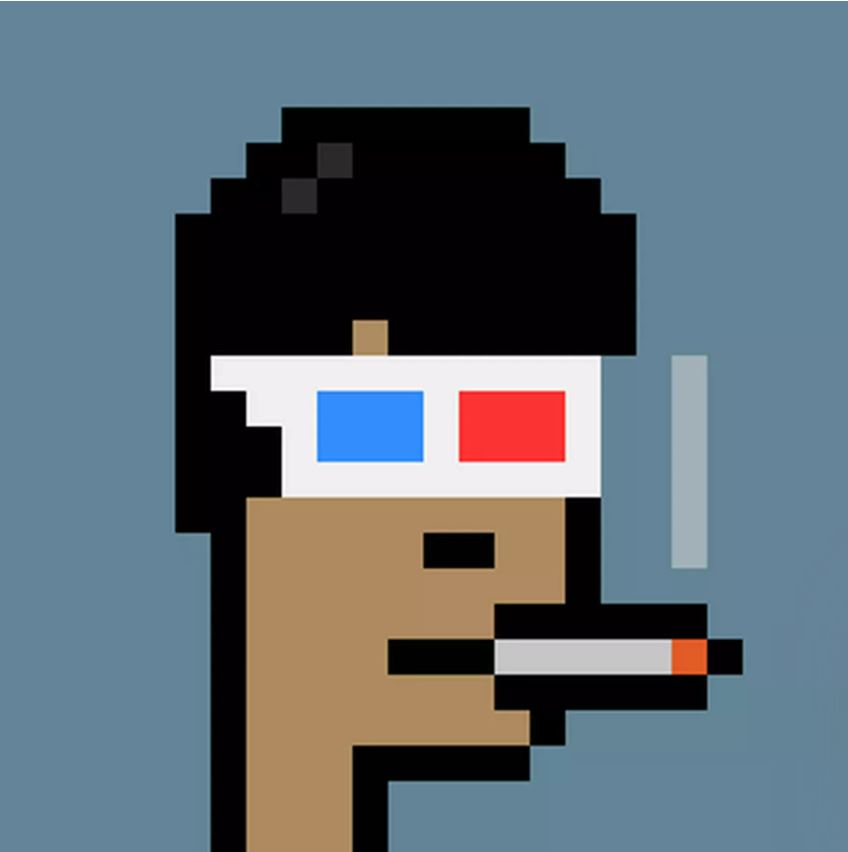

Take a look at the picture below. What might persuade you that an image is worth $9 million if anything?

You’re looking at an NFT, which was one of the first-ever made. It’s from the CryptoPunks collection, a set of 10,000 NFTs released in 2017 when many people were still learning about bitcoin.

You’ve probably already rolled your eyes, either at the $9 million amount or at the concept of NFTs in general. Since March, when nonfungible tokens first became popular, the reaction hasn’t altered much. The general public has criticized them as wasteful and damaging to the environment. The bigger the sale, the more egregious the wrongdoing.

This leads us back to the pixelated fellow above. Richerd, a friendly Canadian software developer, is the company’s proprietor. Around 2013, he began developing cryptocurrency software but grew tired of it. So Richerd purchased CryptoPunk #6046 for $86,000 on March 31 after discovering NFTs earlier last year. He added that it was the most significant buy he’d ever made in his life.

Richerd, who has over 80,000 Twitter followers, declared last month that his CryptoPunk was precious to him and would not be sold at any price. His resolve was put to the test the next day when he received an offer for 2,500 ether, or $9.5 million. It was made not because Richerd’s CryptoPunk is worth that much (comparable NFTs presently sell for around $400,000), but because his bluff was busted in front of the entire world. Although it was a challenge, it was nonetheless a valid offer. Richerd’s wallet would have received 2,500 ether if he had selected “accept.”

Richerd turned down the offer.

“Well, obviously, I said the day before, ‘I’m not selling it for any price,’ so selling it for that price would go against my integrity,” Richerd explained through Zoom. “On top of that, this CryptoPunk serves as my profile picture and brand.” That’s me, everyone knows.”

Richerd’s explanation would have seemed ridiculous to me not long ago. How detached from reality would someone have to be to pay $8,000 for a photo that appears to be a Fiverr job? To turn down that offer, one would have to be scandalously wrong. It doesn’t surprise me in the least after spending a few months researching and following NFTs. It makes a lot of sense.

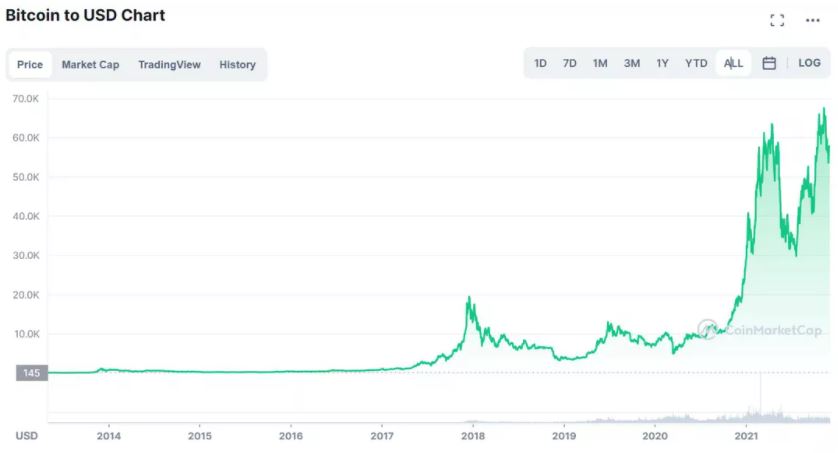

Millionaires in Bitcoin

Here’s a simple fact that helps explain why NFTs cost the same as a CEO’s salary: Over 100,000 people are reported to have become millionaires due to Bitcoin. So it’s no wonder that NFTs exploded in popularity in March. That’s when bitcoin surpassed $60,000, a 500% increase in just six months.

When you see news or a tweet about someone spending a ridiculous amount of money on an NFT, it’s easy to be confused about how stupid that purchase would be for you. It’s easy to overlook that costly items are almost exclusively purchased by very wealthy people, who spend a lot of money on status symbols.

Take, for example, the Bored Ape Yacht Club. It’s a group of 10,000 ape NFTs, each with unique characteristics that make some rarer than others. Rare varieties have sold for over a million dollars, while common variants sell for roughly $200,000. (BAYC developers sold the NFTs for $190 each at the time of debut in April.) BAYC, owned by celebrities like Steph Curry and Jimmy Fallon, is a “profile image collection.” The photographs are primarily intended to be used as your display photo on Discord, where the majority of NFT business is conducted, as well as on Twitter, Instagram, and other social media platforms.

To summarize, a profile photo must cost at least $200,000.

That’s absurd in isolation. When viewed in the context of how wealthy people spend their money, though, it is less shocking. Why spend money when you can right-click and save a JPEG? You can purchase a decent house in a safe neighborhood for $1 million practically anyplace in the world, but celebrities often buy $20 million mansions. Although a trendy dress can be found for less than $500, firms like Chanel make their money by selling them for 20 times that amount.

We agree that wealthy people purchase expensive products offline. Is it so far-fetched to think they’d shop for expensive items on the internet as well?

“How do people flex their riches in the actual world?” According to Alex Gedevani, a cryptocurrency expert at Delphi Digital. “It may be buying a car or a watch.” Is that more scalable than buying a CryptoPunk and using it as my profile picture?”

Status symbols aren’t just for the wealthy. We all indulge in some way, whether it’s buying a $20,000 new automobile when a $7,000 used car will suffice or spending $30 on a T-shirt when Walmart has basic items for under $5. The majority of status symbols have one thing in common: they are designed for a specific target. The banker in his Rolex and the CEO in her Bentley don’t seem to mind if I believe either of their purchases is extravagant. They’re attempting to sway a tiny but strong group of people. The same is true of NFTs.

Richerd, for example, has his own company, Manifold, where he teaches digital artists like Beeple how to use blockchain technology to create art that would otherwise only exist as NFTs. Of course, it helps in certain circles to be a part of the most sought-after NFT collection. He isn’t exaggerating when he says his business is built on his punk roots; a group of investors even named their company after him.

Richerd added, “Anyone who buys a CryptoPunk believes certain things.” “Either you’ve been a long time in the community and believe in what these are, or you’ve paid a lot of money to get in, which demonstrates conviction.”

“I’d like to demonstrate my conviction.” This is one of those projects where you have to back up your words with action.”

Having a little difficulty

NFTs are divisive. A minority number of people believe in the underlying technology (tokens that confirm ownership of digital goods), while the majority believe it is a fraud. The first group can be defensive about the technology’s flaws, just as the second group struggles to perceive any value in NFTs.

And there’s no denying that NFTs have a slew of difficulties.

The first is the perplexing lack of accessibility. Setting up blockchain wallets and other essential digital apparatus is challenging, so software professionals prefer to do well in crypto and NFT trading. Even simple purchases and sales can be risky. If you send money to the wrong wallet address by mistake, it will be lost forever.

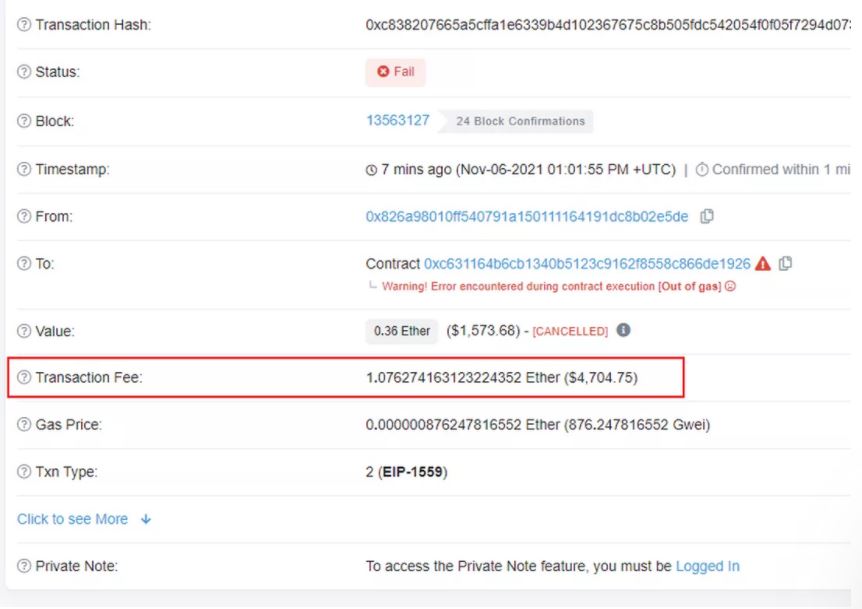

Then there’s the cost. Let’s say you’re interested in putting your toes into nonfungible waters, and you’re willing to risk $1,000. During a public auction, you should expect to spend between $120 and $400 on a new NFT. That is until you consider the transaction fees. The majority of NFTs is based on the notoriously inefficient Ethereum blockchain. The more individuals who use ethereum, whether it’s to trade altcoins or buy NFTs, the higher the fees become. In a favorable situation, you’ll spend around $100 every transaction, though it’s not uncommon to pay twice or threefold that amount. Suddenly, $1,000 doesn’t seem to stretch very far.

This is particularly problematic for NFTs, which have a reputation for producing “gas wars.” Because there are a quadrillion Shiba inu coins in circulation, 100,000 persons could buy them all at once. However, when 10,000 people try to buy an NFT, transaction fees skyrocket as some users outbid each other to expedite their purchase. It may just last a minute or two, but a lot of damage can be done in that time. It’s not uncommon for people to spend more than $10,000 on a transaction fee. Neither are people who lose $1,000 on a botched purchase.

The inefficiency of Ethereum contributes to the other significant issue of NFTs: their high energy consumption. It’s worth noting that this is a conceptual distinction: NFTs aren’t as awful for the environment as ethereum. Other networks, such as Solana, consume a small percentage of the power. Next year, Ethereum developers are scheduled to release an update that would reduce mining energy consumption to 1% of what it is now. While no one knows precisely how much energy ethereum consumes right now, we do know it’s a lot. (Despite its popularity, Bitcoin is much less efficient than Ethereum, which is why absolutely nothing is constructed on its blockchain.)

Finally, the majority of people that trade NFTs do so to make a profit. Scams abound, and prices are constantly fluctuating. The vast majority of people who make, buy, and sell NFTs are unaware of or uninterested in the technology. If there is a technological breakthrough, it is likely to be overshadowed by the wild price swings.

“I’d term it a bubble,” Gedvani added, “since the number of speculators entering the market is outstripping the number of actual creators.”

On the other hand, a bubble can burst and leave something better in its wake. Consider the website Pets.com. It was valued at $290 million at its height in February 2000, but by November of that year, when the famed dot-com bubble began to bust, it had already shut down. It’s used as a warning against speculative bubble trading. However, it appears that the decision to invest in Pets.com was justified. Although that particular endeavor was incorrect, the e-commerce trend it observed was real. Seven-figure pixel art may not last forever, but digital ownership proof, which NFTs are all about, may.

The year 2022 will be significant.

It’s anyone’s guess where NFTs will end up, and everyone who claims to know is usually trying to sell you something. However, we know that the number of people purchasing NFTs is almost certainly going to increase.

On OpenSea, the largest NFT marketplace, it is believed that over 250,000 users exchange NFTs each month. Soon, CoinBase will launch its own NFT marketplace, which has a waiting list of 2 million customers. Similar initiatives are in the works for Robinhood.

More importantly, major corporations that already make money outside the crypto realm are interested in getting involved. For example, the creators of Pokemon Go, Niantic, have just released a new game where players may win bitcoin. In addition, Twitter and the firm formerly known as Facebook aim to include NFTs into their platforms, and Epic Games says it’s open to the idea as well. Imagine a world where, instead of purchasing skins in Fortnite, you buy an NFT for each skin you own, which you can then trade for outfits and weapons in other games or sell once you’re done with it. (Epic has stated that such a system will not be included in Fortnite, but this may not deter competitors.)

Richerd believes that the influx of people who will soon enter the NFT market will result in a greater variety of digital products offered to different consumers. Your neighbor might not be willing to pay $200 on a profile photo, much less $200,000, but they might be willing to spend $10 on a one-of-a-kind skin or a product from Facebook’s Metaverse. Although the space may alter, he is convinced that CryptoPunk #6046 will remain safe for the time being.

“CryptoPunks will be the final one,” he asserted, even if every NFT crashes.